Data & Trust: Your Assets in Market Domination

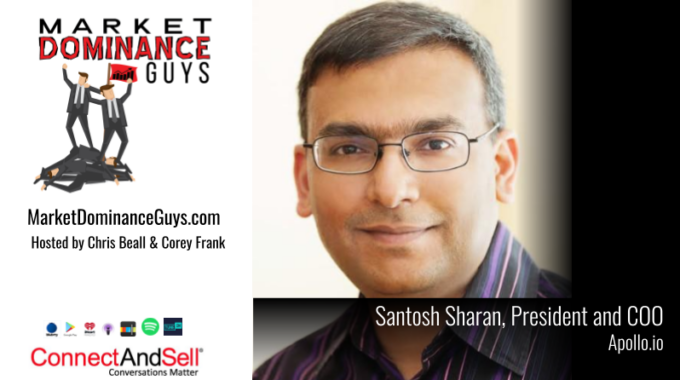

Sales and marketing departments usually operate as two separate entities. Although that’s not healthy for a business, it’s generally the reality in many companies. Santosh Sharan, president and COO of Apollo.io, joins our Market Dominance Guys, Chris Beall and Corey Frank, in this second of three conversations, to talk about the evolution of data as a business asset and how shared data — and unified leadership — can eliminate this unfortunate dichotomy of purpose, and fuse sales and marketing into one weapon with a single goal: market domination. “Sales is simple,” Santosh says, “You’re looking for an edge over your competitors.” It used to come primarily from developing relationships, which Chris defines as gaining your prospect’s trust. Now, though, getting the desired information or data to an interested prospect provides an increasingly important edge — if you can do it faster than your competitors can. And, thus, data joins trust as a necessary tool of sales. Learn more about this and other data- and sales-related insights in today’s Market Dominance Guys’ episode, “Data & Trust: Your Assets in Market Domination.”

The complete transcript of this episode is here:

Announcer (00:06):

Sales and marketing departments usually operate as two separate entities. Although that’s not healthy for a business, it’s generally the reality in many companies. Santosh Sharan, President, and COO of apollo.io joins our Market Dominance Guys, Chris Beall and Corey Frank in this second of three conversations to talk about the evolution of data as a business asset and how shared data and unified leadership can eliminate this unfortunate dichotomy of purpose and fuse sales and marketing into one weapon with a single goal, market domination. Sales is simple Santosh says. You’re looking for an edge over your competitors. It used to come primarily from developing relationships, which Chris as gaining your prospect’s trust. Now though, getting the desired information or data to an interested prospect provides an increasingly important edge, if you can do it faster than your competitors can. And thus, data joins trust as a necessary tool of sales. Learn more about this and other data and sales-related insights in today’s Market Dominance Guys episode, ‘Data & Trust: Your Assets in Market Domination.’

Corey Frank (01:45):

Chris talks about a connected cell and he’s done many a podcast and panel discussion about weasels. And pigs and weasels in data, pigs and weasels and dials, probably in life too. I suppose we could extend this to the zest for life. When you see this Santosh, is it possible that sometimes the intentions, the well intentions that I have as a sales manager or VP or a CRO to get the best data for my team. But, I look at the evolutionary scale. Maybe my marketing eyes are bigger than my sales stomach if you will. Right? And it ties in into Chris, your weasel, and pigs analogy. What do you do when they’re just operating at two different evolutionary mentalities? Who wins? Where’s the lowest common denominator that you can apply that? Does that make sense for both you guys?

Chris Beall (02:39):

Yeah. I’m really mystified, but I do get the pigs and weasels thing. I don’t know Santosh, if you even know our pigs and weasels analogy. But, it goes like this. At ConnectAndSell, we divide our users or people that we meet into two categories, pigs and weasels. We love pigs because pigs are hungry for the next conversation, no matter what the last one tasted like. And we don’t like weasels, because they’re trying to weasel out of the one thing you need to do in sales to gain proprietary advantage, which is hold an intelligent conversation with somebody. When we work with a company that will have sort of a rebellion among the reps who are saying, “We don’t want to talk to anybody. Management is making us talk to people using this horrible ConnectAndSell thing, right? We have a name for that too. We call it a weasel fest.

This actually happens in every field, when you come right down to it. I’ve told this story… Actually, I told it to the Times of India, at one point. I was asked, “What in your career convinced you that you could do anything and be business.” I said is when I was a landscape laborer working on the Indian Bend Wash in Scottsdale, Arizona at the McCormack ranch, soon-to-be McCormack ranch golf course. There were 22 of us on the team using shovels and rakes and stuff like that in order to take the vegetation off the side of this Washington so that it could be nice and pretty and have grass planted on it.

And the shop went union and you know who they got rid of. They got rid of the weasels, this really intelligent company out of Canada, and our three Hungarian bosses were just super smart guys. They identified the weasels and fired them. Because, when we went union, they couldn’t afford all of us and they kept the seven pigs, no matter what the last shovel felt like. The last time we scraped something we were looking to do more, we were looking to improve, right? And so I think you’re right, Corey, it does go all the way down, even into the world of landscape laboring. By the way, the reason I made this little video for the Times of India, as I was convinced by somebody that it would be so bizarre and amazing for people in India to see that a guy who used to be a landscape laborer with a shovel and a rake would be the CEO of a software company. To me, it was just the most normal thing in the world, right?

Where I grew up, sure, that kind of thing would happen. But, in different parts of the world, not only do we have different participation on the internet, but we have different ways that people come into the economy and there’re all those changes going on. Again, all of which need to be captured in data and then used in intelligent ways.

Just to speak on another topic briefly. I came out of the world of electronic catalog and as you know, Corey, I was the guy who was foolish enough to think I could categorize and attribute all the world’s products and services and publish it daily in 14 languages. So, all these new products would come out and sometimes we’d have to make a new category and then we’d know a specialty capacity for start motors have got amperage and they’ve got voltage, they’ve got max RPMs. We knew all of that stuff about every product that was bought or sold in industry.

When I think back on that, and I think about what you just said, Santosh, it’s really interesting to me. You’re saying basically that the people that we want to talk with and their companies are products and they have more and more interesting characteristics depending on what vertical they’re in or what business they’re in and what business we are in. So, it’s actually more complex than the problem that I took on, which was just categorizing and attributing all the world’s products and services. Even though there are a lot of them, there’s 14,000, 15,000 categories. Here we might have a smaller number of categories of people who we want to speak with about business. It’s not just sell to, but speak with about business. But, we ourselves are more complex.

Yeah. That is we are not individuals. We’re companies and companies have a lot more variety than individuals in a lot of interesting ways. So, the cross product of all of that I think is where Apollo and other players in the space, when you look at a Bombora with intent or whatever. It’s like, “How do I figure out my complexity and the complexity of the world of all these people out there and then the rate of change of all of it and get it down to something where I say the next thing I am going to do.” Like Henry does out of the Ironman suit. The very next thing I should do with my time, the one thing I can’t expand as a salesperson or as a businessperson is time. The next thing I should do with my time is try to with this particular person for this purpose.

That’s so fascinating and that does grow without bound. I think that grows, that continues to grow, like that half of folks that aren’t on the internet. Even without them coming onto the internet, this grows truly exponentially because the number of variables on one side, the number on the other side, and the rate of change over time is such that we’re not going to be able to have a unified field theory of it. We’re just going to have to do. We’re going to have guys like Santosh doing the work.

Corey Frank (07:53):

Mm-hmm (affirmative).

Santosh Sharan (07:55):

Yeah, that was well said. Just to follow up on that, within our client base, we see this phenomena that Corey described, where sales and marketing are on completely two different dimensions, right? That’s just the reality of business, not necessarily healthy for the business. Now, how do we address it? I guess, first sharing a single tool stack definitely helps, right? Because their version of reality is shared in that case. Oftentimes in larger companies, they have very different ways. They look at it, they are both acquiring data in different ways. Their ICPs are different. Their personas are different. They want different strategies for go-to-market, outbound versus inbound, and so on. But just sharing, I think, tools, data, even having them report to a single person, leader. I think there are different strategies I’ve seen that help align. So, sales and marketing alignment is a highly discussed topic these days.

Corey Frank (08:54):

Mm-hmm (affirmative). Well, I would imagine, especially with what you do at Apollo and Chris is the mathematician here. I’m not sure what your background is Santosh, but you look at the traditional Cartesian coordinates X, Y-axis. X-axis was maybe to take your earlier historical analogy, Santosh, of name, address, phone number and then, maybe I added zip code to that. Now I have a LinkedIn profile and I have cell number and I have direct number. And then if I have the Y-axis, maybe, I have who my boss is, how many servers I’ve bought, the buying cycles. But then, you have this Z rotational axis that’s happening as well in data. Which is maybe more like you said, the Bombora.

How do you… When you look at all three of those, is the competitive advantage I have as an organization now, to go with my data that has as much of… And I don’t even know if these are the right terms, by the way. I’m a 17th century at least to beat the poetry major as most people know. So, that’s the extent of my math is what I learned from Chris on these podcasts. But is that the right way to look at it is an X and Y and a Z. And that extra traditional data sets that I can get, the intent data or what I’ve purchased in the past. Is that talk about a comic weight again.

Santosh Sharan (10:17):

That’s great… You articulated it very well by the way. So, let me see if I can respond to that, with clarity. With data, or without data, sales is very simple. Like Chris said, they’re selling inventory and they have to sell it faster and more competitive than all the other vendors in the landscape. And they are all trying to do the same, right? So, you are continuously looking for an edge over your competitors. Where does the edge come from? Edge, there was some period of time where edge came from relationships, for instance. Now, we live in this day and age where business is moving at the speed of light and whatnot. So, now the demand origination before a buyer thinks they want something, if a seller knows that they want, or they have a faster sales cycle, somehow they’re able to bring information faster because of automation or so on.

So, there are many elements that play a role into getting that competitive advantage. Whichever team is better into getting to that race faster, they will win. In some cases, maybe relationships still matters. But, we are now we are doing business at far larger scale, where you potentially can’t have relationship with everyone. So, this is where data helps and this data could be on the X, Y, Z, that you computed. But, those are just technicalities, depending on the business you are operating in, maybe just X and Y is enough, maybe you need Z. Maybe you need alpha and beta and other dimensions as well. But, that’s for the business leaders to decide.

Now, the one other thing I’ll add, just another concept is, data is an appreciating asset for an enterprise. It’s not a depreciating asset. What that means is, I truly believe that in several years from now, decades, every company will start to add an amount of data they have to their balance sheet. Because right now they have other forms of assets that are depreciating that are added. But, data is an appreciating asset. Because if you have, let’s say a hundred thousand rows of records of whatever X, Y, Z-axis on multiple, your entire time. Then, you add 10 more records. What does it do? Those 10 more records are increasing the value of the other hundred thousand. Because now you can correlate that and you can increase the value of your existing data. Now you have one more data element by which you can predict their behavior.

So with that in mind, every day that a company accumulates data, it’s actually making the old data stronger and better and more useful. It’s such an important asset. I don’t think most savvy companies have been doing this for a long time. But, bulk of the economy doesn’t look at data. They’re looking at it as a sales tool.

Corey Frank (13:12):

Yeah.

Santosh Sharan (13:13):

They’re not looking at as an institutional knowledge depository.

Corey Frank (13:18):

It’s a shame because I know… Chris, you can chime in on this and Market Dominance Guys, certainly, the premise for the show is about getting to 51% reach in your total addressable market by having trust-based conversations.

Corey Frank (14:09):

And so, Chris, what do you say with what Santosh is communicating? It certainly has an element on the balance sheet and will. I agree with that. That’s very well said. But, in terms of pure market dominance, every conversation I have takes away potentially from the competition. I’m educating my market that more so, and that has a quantifiable aspect, I would assume too. Does it not Chris?

Chris Beall (14:35):

Yeah. It does. I agree deeply by the way, that data is an appreciating asset, which is quite shocking actually to almost everybody if they think it through. But, it’s absolutely correct. And I have some examples I’m looking at right here. So, I’m going to amplify that first. But, it really goes to your point, Corey. I’m looking at the month of October. Today is the 12th of October. The day is not quite done, looking at our own team and asking the question about the quantifiable aspect of data that represents relationships between people who work on our team and therefore our company and folks that we would like to do business with, or at least we’d like to have a meeting with them about doing business.

I’m looking in order of conversion rates, conversation, and meeting conversion rates top to bottom. That’s the efficiency number. Once I start with a conversation, do I get to convert it to a meeting? Here’s the data that represents that appreciating asset of trust that is being built with these folks. First is Cheryl Turner’s follow list. Then there’s, Shea Garber’s missed meeting list, another follow-up list. Then there’s, another follow list, past two calls last 30 days, 31 to 90 days. Jerry Hill’s follow-up list top priority, get it? Reschedule, no-show meetings. I still haven’t come up with a cold list yet. Mark Cajun I’m coming down, down, down. I still haven’t come up with a list of raw data. In other words, this data is data that has started as raw data. It started just as contact information. It’s been processed through the process of having conversations. And now, the results of those conversations are baked into the data so that it’s used differently.

We know precisely when we want to follow up with these people. We know what we want to say to them one to one fully personalized. We know what we hope the outcome will be. That outcome gets recorded. So, I actually think the way all this stuff comes together is that data represents things that are happening within the business and within relationships, but also supports nurturing those relationships in a human way. And, it’s that cycle, I think, that’s the modern magic of data. When the internet started to be usable to do what we’re doing here, which is video over IP. It’s the other void. So, here we are doing video over IP. But, it started doing voice-over IP. And we know that the human voice carries a huge information load, 20,000 bits a second of information compared to the 5,000 bits in an entire email.

So, a quarter of a second of a human conversation is the equivalent of an email. Well, clearly that’s not the words. None of us speak that fast. Even New Yorkers don’t speak that fast. But, what really is happening is, we’re communicating with each other as human beings in order to ascertain whether there’s enough reason to move forward, including, “Do I trust you? Do you trust me?” And particularly if you’re the buyer, you’ve got to trust me more than you trust yourself. I’m the seller, I’m the specialist. I know more than you do about what it is that you think about buying. You’re putting yourself in my hands and you have to trust me before you really care if I’m competent or whether my product’s any good. Because otherwise, what’s the point? The better my product and the less trustworthy I am, the more trouble you’re in. As the buyer, you’re getting in deeper and deeper.

So, it’s really interesting how data and trust and evolving relationships go together on the balance sheet. And nobody has yet set up the, I’ll call it the assay office, to come and appraise your company based on the value of all of that. What we do is just do a subtraction exercise. We take the book value and we subtract it from your hoped-for, or whatever somebody thinks your enterprise value is, transacted or not transacted. We subtract one number from the other and we call it Goodwill. But the Goodwill of today is represented concretely in the data you have and in the relationships tied to that data and represented by that data. And in the ability of that data to further those relationships in ways that let you survive. I equate market dominance in survival. Because to me, if you fail to dominate in the market, and I define a market narrowly. As you know, it’s truly a list of folks such that for each somebody on that list, if you successfully sell to them, it lowers your cost and risk of selling to every other entity on that list.

That’s the definition of a market and they’re bounded by those relationships and that requirement much like surface tension, bounds a water droplet. There’s a reason we don’t have raindrops that are the size of cars. They can only get so big before the movement, through the air breaks them up. The surface tension can’t hold them. Markets are like that. They tend to be smaller than people think. In Santosh’s world, number one thing you do with Apollo’s data is you say, “Well, what’s my market?” Most people do it wrong. They want to go, “How big is it?” The real question is, “How small can I make it so I can dominate it and still produce enough gross profit to exceed my overhead?” That’s the actual business question, not how big is it? So, I can impress some venture capitalists. They’ll write me checks and own my company. But, how small can it be and still be big enough to suit the purpose of dominating?

If I look at that and I say, “Well, how do I know that I’m dominating?” Well, once I make that list. Who am I building relationships with? What do I know about them? And concretely what’s happening? What’s converting to meetings? What’s happening in those meetings? What’s going into follow-ups? Are those follow-ups known or unknown in terms of when they’re going to happen and what the outcomes are? I think though, Santosh, when you say data is an appreciating asset, the mechanisms by which it appreciates, I think are quite fascinating, little measured, and they represent the bulk of our economy now. So basically, we live in a mystery economy as far as I can tell.

Santosh Sharan (20:48):

No. You said so many things that are resonated with me. We certainly… Those Milton and Keen’s economic theories are no longer valid in the current day and age. Market dominance, you said survival is dominance. That’s so true because we live in ‘winner take all’ models. Every segment, if you see there is like a CRM. There are 50 CRM companies, but only one or two of them take 85% of the market share. And then, the rest of them are fighting for jump change. That’s happening in every sector. The reason is very simple because buyers are interconnected. There’s information transparency. So whatever good ideas are getting overhyped, bad ideas are getting over-punished. And that’s happening in the stock market, in asset prices in companies. No different. Humans are human. They just talk to each other and everybody wants to invest in the same thing.

I think this has some very interesting implications on how… As you were going through those lists, what struck me is these lists of your customers are really… It’s like a slice of the market, a prioritized slice of the market they want to go after today. And then, whoever can get to a larger slice, in limited time and expense will win. Really, dominance is about the pace at which they can get more successful outcomes. And outcomes could come because they are experienced or they have, however else. It doesn’t matter. They use one tool or the other, or one approach or the other. But eventually, as they go through these slices of market, fast enough, they have to demonstrate that credibility and trust. That’s kind of the final frontier and…

Corey Frank (22:43):

Credibility and trust. And I would also add to that, as we talked about weasels and pigs, is the mentality across marketing and sales and the executive leadership aligned where they want to dominate a market. Versus they’re just happy to be there. Because I know from a sales reps perspective, I could say, “Listen. I’ll take any MarTech tool that will keep Chris off my butt. That will give me even mere basis points, increases where I can do the same amount of work hours, but maybe do a little bit more performance.” And to me, I think to Chris, I think certainly to you with your success, that’s a mentality that we’ve got to get rid of in our organizations. Because we only want the pigs who say, “Listen now, how do I make the best of a tool like Apollo, a weapon, like Apollo. Best of a weapon, like ConnectAndSell in arm, truly to a Tony Stark like the person who’s inside that suit, who wants to save the world, who wants to save men’s souls.”

Oftentimes that’s misaligned is we have the right intentions from the boardroom, from the CRO, from RP&L, but it gets to the person who actually has to pull the trigger. And they’re like, “Eh, this is cool. But, what do you want me to do with this?” And, that’s certainly frustrating as leaders today. The people who are in the lab with the white jackets and the glasses is on the bridge of their nose and test tubes coming up with this great stuff from the Apollo labs. It’s imported very carefully and there’re all kinds of clean suits putting into the ConnectAndSell weapon and they’re aiming and taking place. But downfield, a lot of the reps are just like, “Eh.” And I think it just bears that the lowest common denominator still oftentimes rules all, in the world of sales and marketing.

Chris Beall (24:28):

Wow. It comes out in so many ways too. It’s such a great point. I’m thinking as you’re describing all that. Somebody like Cheryl Turner, who’s been on this show who works at ConnectAndSell. She’s looking to help every single person she talks with. She knows damn well that they will be helped by attending a meeting to learn about how conversations can change the trajectory of their company’s future. So, she doesn’t let them bill otherwise.

Corey Frank (24:57):

Yeah.

Chris Beall (24:57):

It’s that last maneuver, Scott Webb called me today and said he was excited. Now, this guy’s a chief sales officer of a multi-billion dollar company. He said, “Chris, today, I talked to 10 people that are going to be attending a conference that I’m speaking at. I set meetings with 9 of them. I didn’t get a meeting with the other because he actually won’t be attending. So, I went nine for nine.” I think this is a breakthrough. Right?

That’s, that attitude that we’re talking about, which is regardless of the level in the organization, if you hire for that dominance, that willingness, as they say in the NFL to go across the middle and not get alligator arms. To actually be willing to extend and take the hit in order to make the thing happen. That’s where the magic really happens. I think that’s the flaw in the tech stack approach to sales, is the idea is to say, “I got a stack. Now you don’t have to work anymore.”

Corey Frank (25:52):

Right.

Chris Beall (25:53):

We have a customer that we’re talking with and it’s like, “Well, we’re going to specialize over here and just have the callers. Then, these other SDRs, “Well, they won’t do the data and they won’t do the calling and they’ll use outreach to sync.” What do you mean? Are they going to work at all? Are they going to do anything? I guess they’ll be pushing the button to send the emails in the various directions and maybe that’s going to be effective. Who knows? You know?

Corey Frank (26:14):

Yeah.

Chris Beall (26:14):

Every experiment is worth a shot. But, that last part, and it’s not actually an aggressive attitude about dominance. That’s what’s funny about market dominance. Market dominance is a service to the market. The market wants a player they can trust. And every segment, every sub-segment, every group of self inter-referencing folks really wants the comfort of knowing that they can turn to somebody to solve a particular class of problem today, or when they’re ready to go after that solution. If you fail to establish yourself in that way, with at least one market, you failed them. Who are they going to turn to? Well, apparently somebody else, right?

At the very front lines, that attitude of service, I’ll call it insistent service. I’m going to pull you out of the way of this bus because I know it’s not good to get hit by buses. You just don’t know that yet. And by the way, it’s a foggy day and you don’t see the bus coming. I actually got to do that once with somebody. Got to actually put my hand in front of him, kept him from walking inside in front of a bus. It was a reflex on my part. You think about that and go, “Okay.” That’s what you’re trying to do in sales is, you’re trying to keep somebody from stepping in front of a bus they can’t see, because of the fog. Because, you have fog penetrating radar that can see buses and save lives and as you say, save souls. That’s where the game is played. And I think when you hire, if you hire for that and nothing else, you will succeed in building your business and that’s often not done.

Corey Frank (27:52):

That’s beautiful. Well, clearly that’s what you’ve done in your career Santosh, between Aberdeen and Lead, and certainly why I think that they did everything possible to get you to come over to Apollo as the new president. So, we’re coming up. We’re going to get the hook on time here. And you got a couple of data geeks, three data geeks here who can certainly talk all day about this. But, we always get to this point of these conversations, we talk about the prognostication. Chris hates this part because he doesn’t like to use it. Chris left his crystal ball in his trunk. There you go. There’s his crystal ball. It’s empty. But, when you look at these different levels. We have the X-axis, Y-axis, and the Z. And you mentioned the alpha, beta, and the other dimensions. Where do you see it… Without giving away too many of the trade secrets and what’s going on in Apollo labs, where do you see guys like me on the sales side, getting extra enhancements or extra superpowers, extra spider bites from looking at some of these new dimensions that you…

Santosh Sharan (28:48):

There’s a product that we are already working on. In fact, we already rolled out a version that’s part of Apollo. Think of the job. I don’t think the sales reps job will ever be fully automated. They just tweak a few dial and it works. So, you still have to talk and educate the buyer and pull them out of the bus like Chris says. But, everything else can be automated. Now there is so much data that potentially it cannot consume all the data. It’s not humanly possible. They have 500 accounts they’re sitting on, named accounts and something is happening to each of those accounts every day. There are opportunities popping up. But then, who’s going to tell them? Now, what we have built is not surprisingly, we call it autopilot. It’s inspired by Tesla’s autopilot where the driver still needs to be there in the seat. But then, it assesses you, warns you here and there a few times.

So similarly, we built this autopilot that looks at all the data you have access to. All means, all the CRM data, all the market data, all the changes that are going on. And then, it’ll suddenly pop up an opportunity saying, “Ah, do you realize there was, we used to have this customer, eight months ago. He was a power user because I went and verified the usage logs from… And now he just turned out. He’s joined this company as VP marketing, which could be a great candidate for you.” Now, how in the world would we know? So, by correlating information, based on the past info. There is a mammoth amount of number crunching that needs to happen to find these golden nuggets through hyper correlation of millions of records.

That’s where I think the future… Depends on the timeline, how far we go. But somewhere in near term, I think the data is exploding so much that you need some sort of autopilot or navigated kind of guidance system. Like a side Cape to a rep that will tell them which data to look at. Now, even this autopilot, just recommends feed. It just tells you, “Here are few things I brought up.” It pulls up 10 things every morning. And then you can look at it. You say, “Yeah, this is interesting. This is not interesting.” And then, it learns using AI, and next time it’ll give you more relevant recommendations.

Corey Frank (31:09):

Well, that’s critical.

Announcer (31:11):

Tune in next week for the third part of this interview. If you miss the first one, go back and listen to that too. So, you have the full story and all the advice you are going to need to put you on your way to market dominance.